Anyone who has traveled abroad or shopped online on a foreign website, would probably be aware that credit cards charge a fee for purchases made. Dynamic currency conversion (‘DCC’) is one such currency conversion fee.

Simply put, DCC is a credit/debit card feature that enables a foreign traveler or an online shopperto make a point-of-sale (‘POS’)or online purchase, in a foreign country using the currency of the person’s home country. For example, if a resident of the United Arab Emirates (‘the UAE’) visits the United States, the person can make purchases through his or her credit card by using AED. While the DCC facility lets one avoid the currency conversion and makes it easier to understand the actual price one pays, the service often comes with a poor exchange rate and a service fees, that makes the transaction more expensive than using the foreign currency.

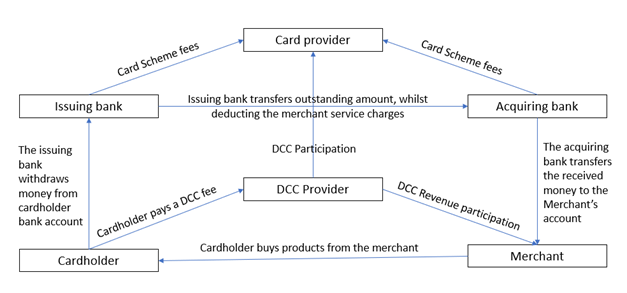

There are various parties involved in a DCC transaction i.e. the bank, the card holder, the card issuing bank, the card acquiring bank, the retailer/merchant establishment and the infrastructure provider. A diagrammatic representation of DCC arrangement is as under:

In the UAE, many banks and financial service providers offer DCC services. From a Value Added Tax (‘VAT’) perspective the following transactions are relevant.Assuming that all the parties and the place of supply, is in the UAE the possible VAT implications could be as under:

1. Income earned purely on account of the forex spread resulting from the currency conversion

The UAE VAT Regulations provides that exchange of currency, whether effected by the exchange of bank notes or coin, by crediting or debiting accounts, or otherwise, shall be exempt. Further it is provided that where the consideration payable in respect of such services is an explicit fee, commission, discount, and rebate or similar, the same would be taxable. Considering the fact that the income is purely on account of the forex spread and is not an explicit fee or commission, the same may be exempted under the UAE VAT Laws. Further the service provider would not be entitled to recover any VAT charged to it that is directly linked to the DCC income.

2. Income earned by the DCC Service provider as a service charge for providing DCC services

This being an explicit fee charged for the DCC services provided to customers could be considered as a taxable supply.

3. Service fees paid to retailers/ merchant establishments for promoting the DCC facility through POS transactionsAND service fees paid to vendors providing the requisite infrastructure to integrate banks, retailers and customers, for providing real-time currency exchange rates, undertaken the currency swap, etc.

These services could be covered under the definition of ‘supply of service’ and hence may be taxable.

Further, depending on the location of the various parties (being outside the UAE) involved in the transaction i.e. the bank, the card holder, the card issuing bank, the card acquiring bank, the retailer/merchant establishment and the infrastructure provider, the VAT treatment could get more complex and one would have to evaluate whether the transaction would qualify as export of service and hence zero rated under Article 31 of the UAE VAT Regulations. It has been observed that different VAT treatments have been adopted and applied by various parties to the transaction, in the UAE. For instance, many retailers/merchant establishments have been booking DCC income under other/miscellaneous income (not being material compared to their core business) without giving the appropriate VAT treatment. Considering the facts that the Federal Tax Authorities have initiated VAT Audits, it would be wise to have a closure look at the above transactions.

Deepak Agarwal

The above expressed views are personal.

Disclaimer : Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. Each article/view/comment posted by third party readers/subscribers of our website on topics of tax and accounting is their personal opinion and due professional care should be taken by you before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate. and is not intended to provide, and should not be relied on for tax or accounting advice.