Self-paced learning allows you to work online and with physical materials on your terms, and in a way which suits your learning style.

This course covers all the fundamental international transfer pricing concepts. After taking the course, you will be able to do transfer pricing studies yourself!

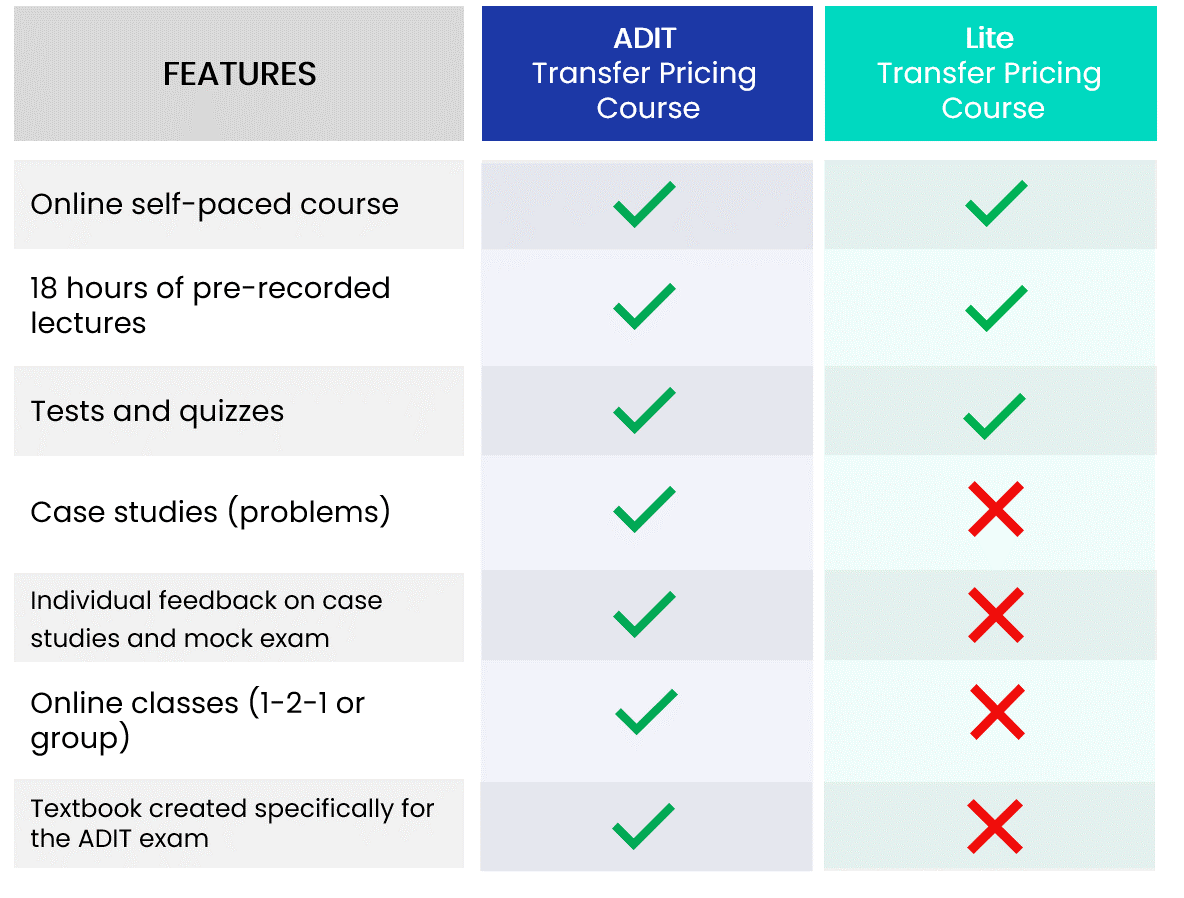

StarTax Lite Transfer Pricing Course provides full theoretical and practical knowledge about aspects of international transfer pricing. To make the course more affordable, we eliminated some of the elements that are more relevant for the ADIT exam preparation, and left only those that are useful for practitioners.

OECD Guidelines and the most recent reports, documents and discussions drafts, including:

UN Practical Manual and draft updates, including:

References to relevant domestic law and practice, including analysis of separate provisions from:

This module introduces the concept of transfer pricing and the arm's length principle. We are going to start with a basic definition of transfer pricing and discuss its importance in tax and general business environment. We will also cover fundamental sources of transfer pricing rules and regulations.

In this module, we are going to look at the practical aspects of the application of the arm's length principle. This section also discusses several key transfer pricing concepts, including "associated enterprises", "controlled transactions", and "comparability".

In this section, we will start studying functional analysis basics, including definitions of functions, assets and risks (FARs), goals of functional analysis and the economic concept of risk.

In this module, we will look at a practical approach to functional analysis, as well as how functional analysis relates to other areas of transfer pricing.

This module sets out some general concepts applicable to all transfer pricing methods.

In this module, we are going to discuss traditional transaction methods. Traditional methods are regarded as the most direct means of establishing whether conditions in the commercial and financial relationship between associated enterprises are at arm's length. As a result, when a traditional method and a transactional profit method can both be applied in an equally reliable manner, the traditional method should be preferred.

In this module, we are going to discuss transactional profit methods. These methods are relatively new, having only been introduced to the OECD Guidelines in 1995. Since its introduction in 1995 and after the elimination of the strict hierarchy of the methods, transactional profit methods became almost the default choice for taxpayers. This is due to their versatility and flexibility, which allows them to be applied to nearly every transaction.

In this module, we are going to start the discussion about comparability analysis. Comparability analysis is a cornerstone of the application of the arm's length principle. Firstly, we will look at the theoretical background around comparability factors and approaches. The next module will continue the discussion and will focus on the application of comparability analysis in practice.

In this module, we are going to discuss the application of the OECD approach to comparability analysis in practice. In particular, we will focus on comparability analysis in the context of comparable companies (or non-transactional data).

In this module, we are going to discuss the specifics of the transfer pricing for intra-group services. The service sector is the most rapidly growing part of the economy – the Fortune 500 list contains more service companies than manufacturing businesses. In recent years, the value of services has accounted for more than 75% of GDP in high-income countries. In the context of transfer pricing, around 35% of controlled transactions are service transactions.

In this module, we are going to cover perhaps the most controversial and challenging topic in transfer pricing - intangibles. While analysing intangibles from a transfer pricing point of view, it is necessary to always use common-sense. Transactions involving intangible property are often scrutinised by tax authorities worldwide. Almost every transfer pricing dispute involves intangibles to some extent.

In this module, we are going to discuss the transfer pricing aspects of business restructurings. We will start with the definition and explore the tax and transfer pricing implications of different types of reorganisations. MNEs are living businesses that must be able to adapt to business reality quickly. In the modern globalised world, new markets emerge and collapse rapidly, and MNEs have to adjust their structures to be able to use new opportunities and avoid threats and risks.

A Cost Contribution Arrangement (CCA) is one of the common frameworks for MNEs to develop and exploit intangibles and services. The transfer pricing of CCAs is a complex topic that attracts considerable public attention. Both the OECD Guidelines and the UN Manual have separate chapters dedicated to CCAs. Also, some tax authorities have developed detailed guidance and regulations on CCAs that provide useful insight into their approach. The topic of CCA is closely linked to intragroup services and intangibles; thus, we recommend familiarising yourself with these two types of transactions before moving to CCA.

Transfer pricing of financial transactions is perhaps the most technically sophisticated topic in the ADIT course, and in transfer pricing practice overall. While most standard business structures and transactions (such as contract manufacturing or limited risk distribution) are quite intuitive, financial transactions can be difficult to understand. This module will provide you with an overview of the most important transfer pricing tools to determine the arm's length nature of the intra-group financial arrangements.

The PE concept is a cornerstone of the modern international tax system and forms the basis of how MNEs are taxed. In this module, we will see how important PEs are and how they overlap with the transfer pricing and the arm's length principle.

Transfer pricing compliance is where transfer pricing theory meets reality. Transfer pricing compliance includes two principal elements: firstly, MNEs must be compliant with the arm’s length principle, e.g., conduct their controlled transactions at arm’s length; secondly, MNEs should comply with transfer pricing documentation and reporting obligations. In this module, we will focus on the second element, e.g., transfer pricing documentation compliance. We will also look at how tax authorities perform transfer pricing risk assessments, as well as how companies should ensure that their transfer pricing practices and documentation approaches are in line with the requirements and regulations.

During a transfer pricing audit, tax authorities may identify non-arm’s length transactions, and propose a price adjustment that would usually result in higher profits for a taxpayer, and higher tax to be paid. The adjustment may result in a situation in which the same MNE profit is taxed twice, giving rise to a double taxation issue. In this module, we will discuss different types of transfer pricing adjustments. We will we will also consider instruments that can resolve the double taxation issue - the Mutual Agreement Procedure (MAP), which seeks to eliminate double taxation after the adjustment is made, and Advance Pricing Agreements (APA), which can prevent double taxation issues in the first place.

In this module, we are going to discuss how transfer pricing is connected with customs valuation, what the main differences are, and if there is an opportunity to harmonise the two areas in the future. We will also look at recent global developments in transfer pricing and will consider the perspectives of international tax reform, as well as the effects of the COVID-19 pandemic on transfer pricing.