Whistle-blowers can play a huge role in implementing strategies to avoid tax evasion at the ground level, challenging corruption, and sensitizing citizens to act up against misspending of their tax money.

In 2003, the crucial role of whistle-blowers, and the need for whistle-blower protection, was recognized as a part of international law when the United Nations adopted the Convention Against Corruption. This Convention was signed by 140 nations and formally ratified, accepted, approved, or acceded by 137 nations, including the United States.

Support for whistle-blower protection in international law can also be seen in the African Union Convention on Preventing and Combating Corruption and the Organization of American States Inter-American Convention against Corruption. International organizations have also been influential in pushing for greater international adoption of whistle-blower laws and best practices, including the Group of Twenty (G20), the Organization for Economic Cooperation and Development, and the Asia-Pacific Economic Cooperation (APEC).

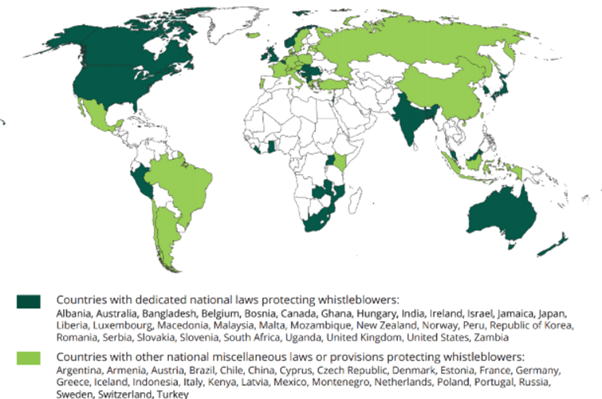

At the national level, there has been a growing global interest in establishing whistle-blower laws. whistle-blower protections have been enacted in at least 59 countries. Without adequate protection and rewards, however, many laws still fall short of supporting effective whistleblowing.

FIG 1 - Countries with national laws to protect the rights of whistle-blowers

Environmental Law Institute (2019) Environmental Rule of Law: First Global Report

Whistle-blowers are one of the best tools for detecting crime, but these individuals are often subjected to retaliation for their actions. That’s why whistle-blower protections are so vital.

Whistle-blower protection programs vary from nation to nation-

INDIA – In India, the law gives protection to only the whistle-blowers who are public sector employees.

JAPAN AND SOUTH KOREA – In these East Asian nations both public and private sector employees are protected.

In some countries, only government employees may qualify as public sector whistle-blowers, whereas in countries such as MEXICO, PORTUGAL, AND NORWAY, a wide range of individuals, including former employees, contractors, or suppliers, can qualify as public sector whistle-blowers.

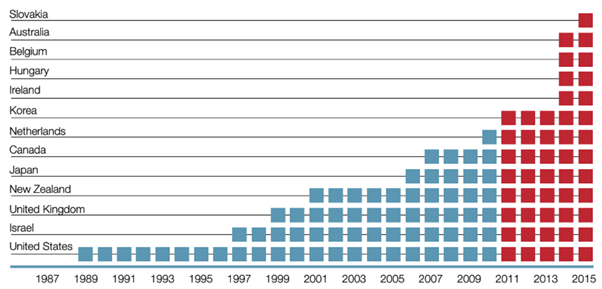

Historically, more laws existed to protect public sector employees, but laws that protect both public and private employees have become increasingly common. Early whistle-blower protection laws in many countries existed as sections of existing laws, but dedicated whistle-blower protection laws have also become increasingly common.

FIG 2 – Timeline of whistle-blower protection laws being implemented all around the world

OECD (2016) Committing to Effective Whistle-blower Protection. The figure shows the adoption of dedicated whistle-blowers laws before and after the 2009 adoption of the OECD Anti-Bribery Recommendation on public and private whistle-blowers.

Whistle-blower protections can also take a wide range of forms. These include sanctions against perpetrators of retaliation, the right to refuse to participate in wrongdoing, and, in some cases, physical protection for whistle-blowers and affected family members. In 2014, the OECD found that the countries with the most comprehensive whistle-blower laws were the UNITED STATES, CANADA, JAPAN, AUSTRALIA, SOUTH KOREA, THE NETHERLANDS, NEW ZEALAND, AND THE UNITED KINGDOM

Protecting the identity of the whistle-blower is also important to protect his/her identity to avoid any kind of backlash. While most whistle-blower laws contain confidentiality provisions, some countries like SLOVAKIA AND AUSTRALIA stand out. “Breaking the Silence,” a 2015 report by BluePrint for Free Speech, evaluated confidentiality protections in G20 countries. The report found strong confidentiality protections for public employees in INDIA, CANADA, AND AUSTRALIA and strong confidentiality protections for both public and private employees in THE U.S. AND SOUTH KOREA.

The regions of Latin America and Southeast Asia were found lacking in protecting whistle-blowers while countries of Central Asia, the Middle East, and Africa were found to be actively hostile towards whistle-blowers and generally unsafe for them.

Reward laws are the most powerful tool for incentivizing whistle-blowers to report. In 2015, the National Whistle-blower Centre published a report on the topic, Whistle-blower Reward Programs: An International Framework for the Detection of Corruption and Fraud. The report identified that U.S. whistle-blower reward laws are highly effective at incentivizing whistle-blowers, including a whistle-blower in countries around the world, to report fraud, waste, and abuse. The report outlines a model for similar whistle-blower laws around the world.

Between 1986 and 2020, whistle-blower cases under the FCA have brought in $46.5 billion to the U.S. Treasury. Of that amount, whistle-blowers received $7.8 billion in rewards. Other U.S. reward laws have been similarly successful. Since the Dodd-Frank SEC whistle-blower program was created in 2011, enforcement actions from whistle-blower tips have resulted in $2 billion in financial remedies and more than $720 million has been awarded to whistle-blowers.

In South Korea, the National Tax Service maintains two reward programs that allow individuals with significant information on tax law violations to report. Since 2012, the number of cases has increased each year and whistle-blowers have been awarded $44 million dollars.

In 2014, the Canadian Revenue Association introduced a reward program for whistle-blowers to report tax fraud. In the year following the introduction of the law, previously unreported offshore income and assets doubled. In 2015, Ontario became the first Canadian province to introduce a whistle-blower reward law for reporting securities fraud. The law allows whistle-blowers who report securities fraud to the Ontario Securities Commission to receive 5% to 15% of the total monetary sanctions. As of 2020, the program has received more than 200 tips and three recent awards totalled $7.5 million.

The Ghanaian Whistle-blower Act was the first to introduce whistle-blower rewards in Africa. In 2020, Ghana also introduced new incentives for whistle-blowers, leading to an increase in the number of reports by whistle-blowers. However, Ghana’s whistle-blower program has also been undermined by retaliation against whistle-blowers.

SOURCE – NATIONAL WHISTLEBLOWER CENTER

https://www.whistleblowers.org/whistleblower-laws-around-the-world/

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax