Recently completed three tax audits by the Federal Tax Authority (FTA) and there are few crucial points to address for the efficiency and ease of Audit for everyone.

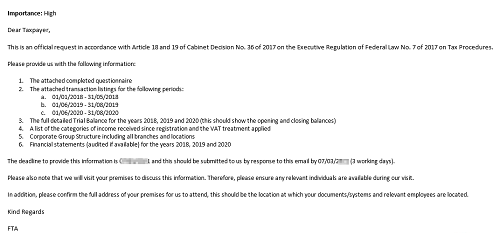

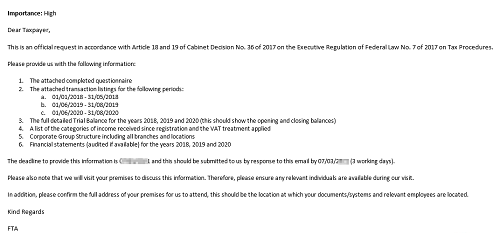

Below is the FTA audit notification

- Communicate the tax advice/treatment in the engagement letter with your client or employer. The best way to document your advice is to communicate via email which can be followed by a discussion with the client or employer.

- If the entity is in a refund position prepare a refund request as per the FTA excel template. Where the entity is in a payable position, it is advised to prepare the transactions listing (same as FTA excel template for refund request. This shall come in handy when an explanation is demanded by the tax auditor

- In some instances, the accountant enters multiple purchase invoices in a single transaction which cause further delay to respond when the FTA demands the data.

- Advise your client or subordinate to record each transaction separately. Or request them to provide standard rated purchases in excel format which shall be invoice wise.

- Prepare the reconciliation along with the VAT return. Reconciliation should be done between the trial balance and the report submitted to the FTA quarterly.

- Trial Balance should be ready with opening and closing balances quarterly. All sales and other income ledgers must be reconciled with the VAT report. Two supplies can create differences while comparing the output as per profit or loss statement and VAT report i.e. out of scope and profit margin scheme sales. A proper quarterly output reconciliation can save you from big trouble in the future.

- Let's talk about the tax audit and how I was successful in reversing huge tax penalties through reconsideration. To begin with, documentation of every tax treatment saved me from the blame game by my client. In the last one and a half years of a tax audit,my books were defined and justified as per UAE tax law except for one tax treatment where management chose to book zero-rated instead of standard rated sales when exporting goods on behalf of the UAE customer.

- As we know, VAT is a supply-based tax, and tax treatment cannot be changed based on the final destination of goods. Resultantly we had no other choice but to submit several voluntary disclosures (VD) to correct the supply once highlighted by the tax auditor of the FTA.

- The invoices revised from zero-rated to standard rated were submitted to the customer by changing the invoice date to the current date and the date of supply referring to the original date of supply. With effective communication with the customer, we were able to convince them to claim the input VAT in the current VAT return.

- The final thing which affects my client adversely was VD fixed percentage and late payment penalty (before Cabinet resolution No. 49 of 2021). We decided to submit the reconsideration form against the penalties (Around AED 1 million).

- In the comprehensive reconsideration letter, we highlighted the effect of the penalty and the Pandemic situation on the business which also included briefing of the background, we also requested to waive off the penalties. After several earnest requests, the FTA reconsideration committee approved the waiver.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax