Today we are going to discuss about Profit Margin Scheme. As per UAE VAT Law under normal circumstances, the 5% VAT is calculated on the sales price. However, there is an exception, the VAT can be calculated on the profit instead of the sales price. This is known as Profit Margin Scheme.

As per the Article 43 of Federal Decree-Law No. 8 of 2017 on VAT (“VAT law”), the Registrant may, in any Tax Period, calculate and charge Tax based on the profit margin earned on the Taxable Supplies and not based on the value of these supplies, and shall notify the Federal Tax Authority (FTA) of the same. The profit margin is the difference between the purchase price and the selling price, and the profit margin shall be deemed to be inclusive of Tax.

As per the Article 29 of the Executive Regulation of the “VAT law”, the following are the Requirements -

1. Second-hand Goods – tangible moveable property that is suitable for further use as it is or after repair;

2. Antiques - goods that are over 50 years old;

3. Collectors' items - stamps, coins and currency and other pieces of scientific, historical, or archaeological interest.

1. Goods should be purchased from either:

1.1 A person who is not registered under UAE VAT or

1.2 A Taxable Person who supplied the goods by reference to Profit Margin Scheme

2. Input tax was not recovered on the purchase of the goods

1. Stock book or a comparable record showing details of each Good purchased and sold under the profit margin scheme

2. Purchase invoices showing details of the Goods purchased under the profit margin scheme.

1. The goods which are eligible under the profit margin scheme are those which have previously been subject to tax. Hence, if goods were purchased in 2017 year or earlier then the goods is not eligible to be sold under the profit margin scheme and VAT should be applied to the full selling price.

2. The Registrant must have evidence that goods have been previously subject to tax to apply the profit margin scheme. Like date the good was first manufactured, sold or brought in to use or a copy of the tax invoice.

3. Additional Reporting Requirements, We need to select yes in case we apply PMS during the tax period

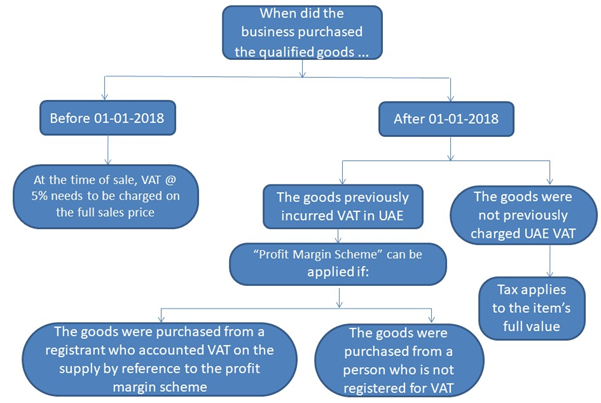

Moreover, please find below a flowchart for quick reference -

Also checkout the video here

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax