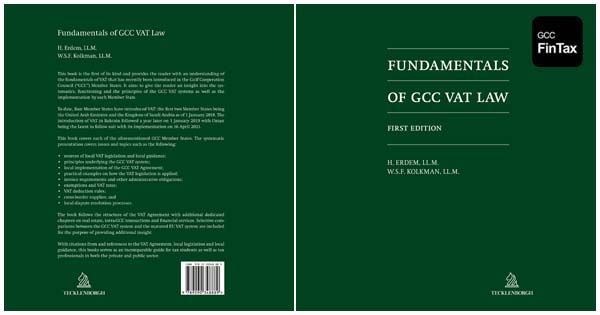

This book is the first of its kind and provides the reader with an understanding of the fundamentals of VAT that has recently been introduced in the Gulf Cooperation Council ("GCC") Member States. It aims to give the reader an insight into the systematics, functioning and the principles of the GCC VAT systems as well as the implementation by each Member State.

To date, four Member States have introduced VAT: the first two Member States being the United Arab Emirates and the Kingdom of Saudi Arabia as of 1 January 2018. The introduction of VAT in Bahrain followed a year later on 1 January 2019 with Oman being the latest to follow suit with its implementation on 16 April 2021.

This book covers each of the aforementioned GCC Member States. The systematic presentation covers issues and topics such as the following:

The book follows the structure of the VAT Agreement with additional dedicated chapters on real estate, intra-GCC transactions and financial services. Selective comparisons between the GCC VAT system and the matured EU VAT system are included for the purpose of providing additional insight.

With citations from and references to the VAT Agreement, local legislation and local guidance, this book serves as an incomparable guide for tax students as well as tax professionals in both the private and public sector.

To order the book, kindly visit www.tecklenborgh.com

Halil Erdem (1988) is a tax lawyer with PwC and the head of PwC's Tax Academy in the Middle East, operating from Dubai. Halil advised companies on cross-border and domestic VAT matters with respect to Dutch, EU and GCC VAT. Halil has been instrumental in various VAT audits across multiple EU and Middle Eastern jurisdictions. In addition, Halil has been extensively involved in the GCC VAT implementation and served as an in-house adviser for both EU and GCC multinationals.

Halil is professionally qualified as a tax advisor in the Netherlands. Halil obtained a bachelor’s degree in Dutch Law and an LLM in international and European tax law from the University of Amsterdam, the Netherlands. Halil has developed and overseen numerous VAT training programs across the GCC. His key strength is the simplification of complex tax technical topics and making complicated legislation understandable.

Wouter Kolkman (1990) is a tax lawyer with DLA Piper in the Netherlands and a key member of DLA Piper's tax team operating from the Dubai office. Wouter's practice focuses on VAT and other indirect taxes such as import duties and excise tax. His clients include multinational companies, investment funds and governmental institutions. Wouter has been involved with governmental GCC tax projects since the summer of 2017.

Wouter is professionally qualified as both an attorney at law (registered with the Amsterdam bar) and a tax advisor in the Netherlands since 2015. Wouter received his law degrees (LLM in corporate law and LLM in tax law) at Leiden University, the Netherlands in 2014 respectively 2015. In 2021, he completed a post-master in EU customs law at EFS Erasmus University Rotterdam, the Netherlands.

The views expressed in this book are solely those of the authors in their private capacity and do not in any way represent the views of their respective employer.