In order to meet the European Union criterion 2.2 and Base erosion and profit shifting (BEPS) Action 5 minimum standard of OECD, the Kingdom of Bahrain has imposed economic substance requirements on entities that carry on geographically mobile business activities.

Therefore, the Ministry of Industry, Commerce, & Tourism (MOICT) and the Central Bank of Bahrain (CBB) have issued Ministerial Order number 106 of 2018 and Directive (OG/499/2018) respectively, which provide an initial guidance on demonstrating Economic Substance.

The purpose of the ministerial order is to enhance economic substance requirements in the Kingdom of Bahrain and clarify the requirements for any Traders carrying out certain types of Relevant Activities in or through Bahrain (other than those activities undertaken by licensees of the Central Bank of Bahrain).

The ministerial order came into effect on 1 January 2019 for new commercial registrations (CR) and existing CRs that apply to any of the relevant activities mentioned in this document. For all other CRs, this ministerial order will come into effect on 1 July 2019.

Relevant Entities & Relevant Activities:

The entities within scope would be those entities formed under the MOICT legislations that are carrying on a relevant activity, which can be identified as follow:

1. Distribution and service center activities

2. Headquarters activities

3. Holding company activities

4. Leasing activities (other than those activities undertaken by licensees of the Central Bank of Bahrain)

5. Shipping activities

6. Intellectual property activities in Bahrain

7. Banks (covered in CBB’s directive)

8. Financing companies (covered in CBB’s directive)

9. Insurance (covered in CBB’s directive)

10. Investment Business Firms (covered in CBB’s directive)

11. Fund Administrators (covered in CBB’s directive)

The Ministerial Order requires a relevant entity that is carrying on relevant activities to satisfy the Economic Substance Test in relation to each relevant activity. Such a relevant entity will also have notification and reporting obligations under the Ministerial Order 106.

The term “relevant activity” does not require an entity to be actively engaged in the businesses listed above, i.e. passive collection of income from one of the foregoing businesses would be a relevant activity.

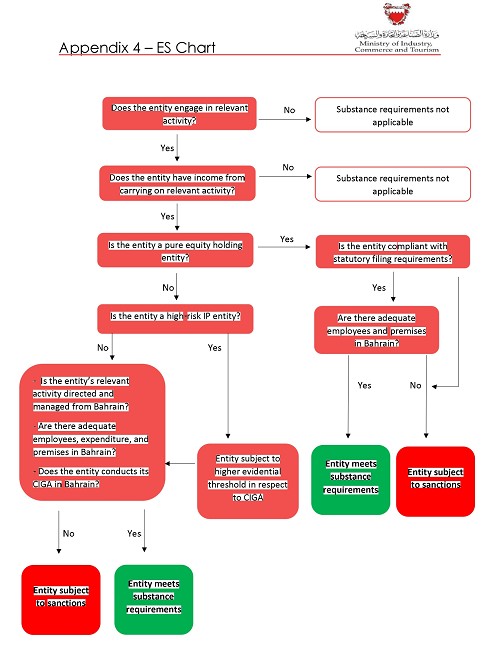

Economic Substance Test:

Demonstrating a substantial economic presence can be satisfied by way of a two-part test:

The first part of the test determines whether the relevant entity is conducting its core income-generating activities (CIGA) in The Kingdom of Bahrain. Industry-specific CIGA are outlined in article 3 of the MO 106. You are encouraged to refer to the MO to determine the CIGA relevant to your entity. The CIGA should be undertaken with:

• An adequate amount of annual operating expenditure;

• An adequate level of qualified full-time employees;

• An adequate number of physical offices.

A relevant entity is prohibited from outsourcing any of its core income generating activities to an entity or person outside of The Kingdom of Bahrain; but it may outsource such activities to a service provider within Bahrain provided it is able to demonstrate adequate supervision of the outsourced activity and the activities took place within Bahrain.

The second part of the test determines whether the relevant entity’s direction and management are located in The Kingdom of Bahrain, which is satisfied by five requirements:

1. an adequate number of meetings of the relevant entity’s board of directors must take place in Bahrain;

2. at least a quorum of the board must be physically present in Bahrain during the meetings;

3. strategic decisions concerning the relevant entity must be made at the above-mentioned meetings and recorded in the meeting minutes;

4. all of the relevant entity’s records and minutes must be kept in Bahrain; and

5. the board of directors as a whole must possess the necessary knowledge and expertise to discharge its duties.

Economic Substance Report (Information reporting):

The Economic Substance regulation requires all registered entities who are conducting any of the above activities to file an annual return with the MOICT. These returns are submitted through the Ministry’s Sijilat system either by company or its agent, i.e. Auditor or professional body.

Generally, the Economic Substance report includes but is not limited to:

1. Core Income Generating Activities (CIGA) of a Trader

2. Structure of the board (number, names, nationality, experience)

3. Number and place of board members’ meetings

4. Strategic decisions, including where they are taken

5. Number, experience, qualification, duration of employment and type of contracts of employees

6. External auditor name and terms of contract with services provided.

7. Annual operating expenditures and annual income

8. Physical address / offices of the company

9. Traders’ confirmation (with explanation) that an adequate set of internal policies and controls for company operation are maintained

10. Traders’ confirmation that they are maintaining adequate and proper books of accounts that contains type of business, amount and type of gross income, and amount and type of expenses.

11. Detailed business plan which allow to clearly ascertain the commercial rationale of holding IP assets in Bahrain (this is applicable to high risk IP traders only).

12. Traders’ confirmation with supporting concrete evidence that decision making is taking place in Bahrain.

13. Trader’s confirmation with supporting explanations and documents that there were adequate premises, number of staff, income, expenditure incurred

14. Trader’s confirmation with supporting explanations and documents about any outsourced activities.

15. Notification if any of resignation of directors and officers responsible for managing the traders.

16. Immediate and ultimate parent company, and ultimate beneficial owner of the Trader, together with their jurisdiction of tax residence

Timeline for ESR Reporting:

A trader/entity that is carrying on a relevant activity and is required to satisfy the ES Test must prepare and submit to the Ministry of Industry, Commerce and Tourism a report for the purpose of the Authority’s determination whether the ES Test has been satisfied in relation to that relevant activity.

The report must be made and submitted within three months after the last day of the end of each financial year of the relevant entity commencing on or after 1 January 2019.

Other requirements (submissions with MOICT):

An entity must inform MOICT of the following within 30 days:

A. Resignation of directors and officers responsible for managing the Traders;

B. Change of information with regard to the place of business or office in Bahrain; and

C. Change in constituent documents and business plans of the Traders.

An entity must also obtain approval form MOICT for any of the following:

A. Establishment of offices outside Bahrain

B. Change of shareholders

C. Appointment of directors

Furthermore, an entity must be required to provide the MOICT information related to its immediate and ultimate parent company and ultimate beneficial owner with their jurisdiction of tax residence.

Additionally, an entity must indicate its name and CR number clearly on its letterhead, documents, website, and social media platforms.

Finally, an entity must file a return / report to MOICT (with documentation) to prove that it has complied with all the requirements including the adequacy, management, and outsourcing tests. A trader/entity who fails to submit such report will not be able to apply for a new CR nor renew an existing one.

Penalties/Sanctions:

Based on article 9 of the ESR, an entity undertaking a relevant activity that:

a) Fail to file an annual return; or

b) Fail to meet the economic substance requirements for relevant activities i.e. does not demonstrate economic substance, will be deemed non-compliant and will be subject to sanctions.

Non-compliant entities may be subject to one or more of the following actions:

Factors that will dictate the type of sanctions imposed will depend on the type of breach, the number of times it has happened, and the MOICT’s judgement.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. Each article/view/comment posted by third party readers/subscribers of our website on topics of tax and accounting is their personal opinion and due professional care should be taken by you before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate. and is not intended to provide, and should not be relied on for tax or accounting advice.