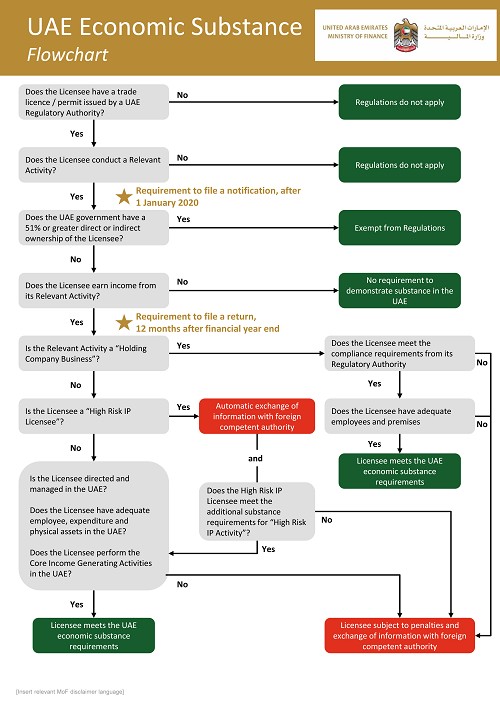

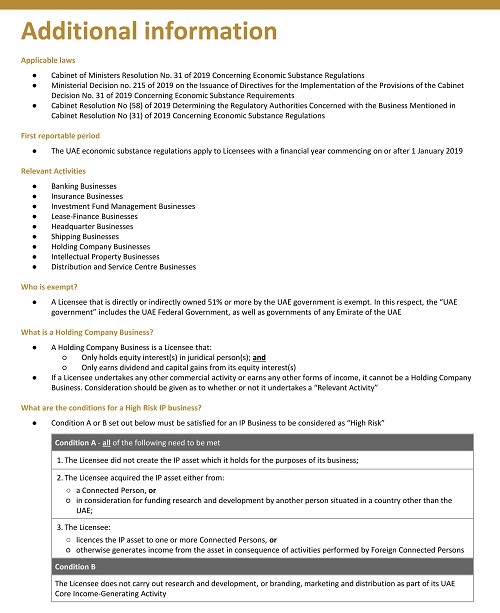

On 30 April 2019, the UAE Cabinet issued the Cabinet of Ministers Resolution No.31 of 2019 (concerning economic substance regulations in the UAE, “the Regulations”), requiring all in-scope UAE entities (“Relevant Entities”) that carry on certain activities (“Relevant Activities”) to have demonstrable economic substance in the UAE from 30 April 2019. Notification & reporting for ESR will start from 1st Jan 2020 onwards.

Relevant Entities means all the licensed entities or persons licensed by the competent authority in U.A.E (including Free Zone Authority). Except the companies owned by the Federal Govt. or Govt. of Emirate of U.A.E or any Govt. auth. or body having ownership more than 51%.

Relevant Activities as per ESR:

Activities related to Banking Business, Insurance Business, Investment Fund Management Business, Lease-Finance Business, Headquarters Business, Shipping Business, Holding company Business, Intellectual Property Business and Distribution & Service Center Business.

Economic substance Test:

The Licensed entities must fulfill all the criteria to meet the Economic Substance Test in relation to any relevant activities carried on by it (i.e. adequate qualified employees, physical assets & expenditure in the UAE, Core Income Generating Activities (“CIGAs”) are undertaken in the UAE, Directed and managed in the UAE etc.).

Requirement to provide information/reports: To Regulatory Authority (An Authority as per the resolution of Cabinet Ministers)

The licensed businesses shall notify the Regulatory Authority annually of the following –

Penalty for non-compliance:

Failure to comply would result in administrative penalties (not less than AED 10,000 but not exceeding AED 50,000 in the first year, increased to an amount not less than AED 50,000 but not exceeding AED 300,000 in the subsequent year), subject to a six-year limitation period. Additional penalties such as suspending, revoking or not renewing the UAE Relevant Entity’s trade license may also apply.

Disclaimer : Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. Each article/view/comment posted by third party readers/subscribers of our website on topics of tax and accounting is their personal opinion and due professional care should be taken by you before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate. and is not intended to provide, and should not be relied on for tax or accounting advice.