Zakat, Tax and Custom Authority [ZATCA] has recently published E-Invoicing Regulations including the Control Requirements, Technical Specifications and Procedures of E-Invoicing Implementation. The Regulations also specifies the definition of e-invoices, other important information and timelines.

According to the Regulations, E-invoicing implementation is mandatory across Saudi Arabia starting from 4th of December 2021, for resident taxpayers and third parties who issue tax invoices on behalf of taxpayers subject to Value Added Tax [VAT].

Moreover, in line with E-Invoicing Regulations, all provisions and mandatory fields of tax invoices as per the KSA VAT regulations will be considered for E-Invoicing in addition to new mandatory fields.

It is important to note that E-Invoicing will be implemented across KSA in two phases as below:

This phase will go-live on 4th of December 2021 where all taxpayers are required to generate and maintain e-invoices using a complaint IT business solution. Taxpayers must issue e-invoices in accordance with Saudi VAT Regulations, in addition to the below new mandatory fields:

Furthermore, in Phase One there is no specific format for E-invoices, and they must be archived as per KSA VAT Regulations.

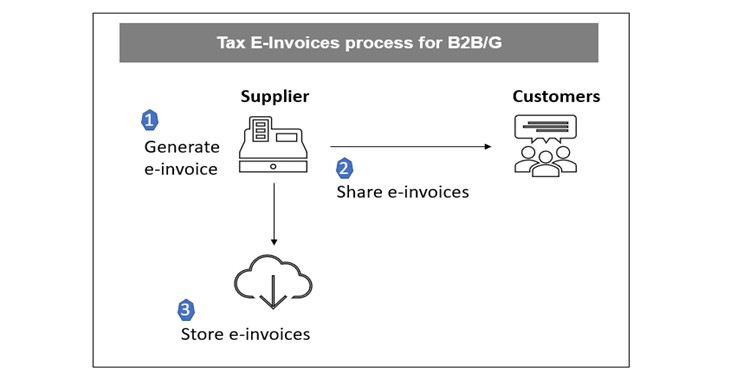

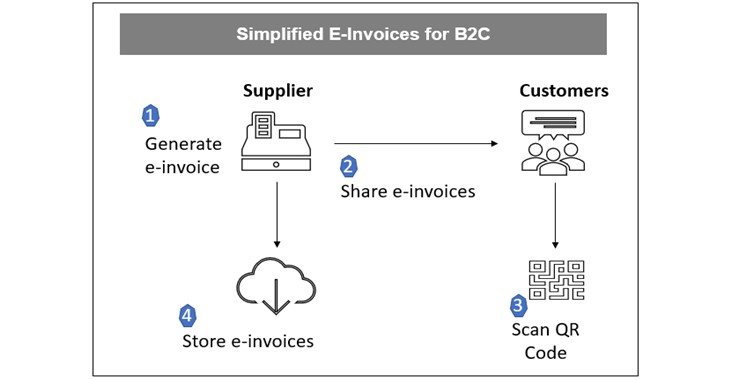

The below diagrams illustrate e-invoicing process in Phase One for both Tax e-invoice and Simplified e-invoice:

Phase Two will come into effect on January 2023 whereby taxpayers are required to integrate their system to generate e-invoices, debit and credit notes and share them with ZATCA. However, ZATCA will implement this phase in waves by targeted group of taxpayers. Accordingly, taxpayers will be informed by ZATCA at least six months in advance about date of their integration phase.

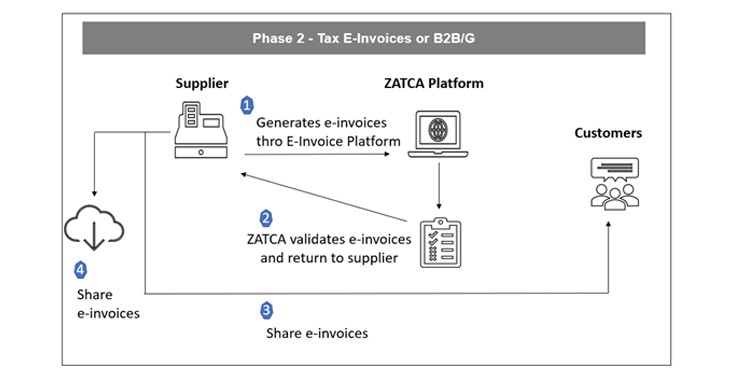

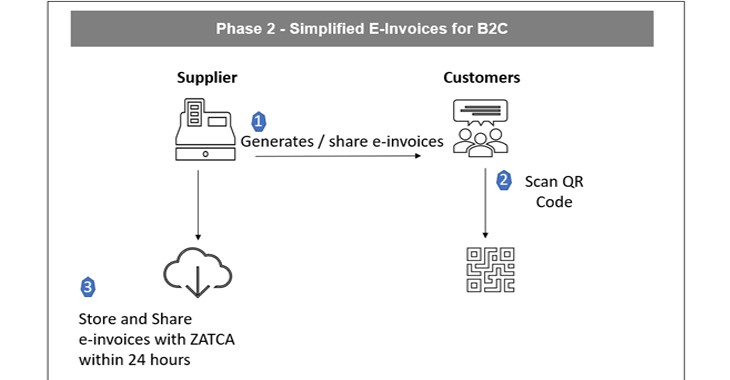

The below diagrams illustrate e-invoicing process in phase Two for both Tax e-invoices and Simplified e-invoices:

In Phase Two, each tax e-invoices must be cleared by ZATCA so these invoices be valid and legal. ZATCA will be using the Clearance Model for tax e-invoices which is a real-time transaction integration model. In this model, taxpayers send tax e-invoices directly to the E-Invoicing Portal prior to sharing with the customers. Then, e-Invoices will be validated across several categories and if approved, will be stamped by ZATCA and return to the taxpayers so they can share them with their customers.

Moreover, in respect of simplified e-invoices, ZATCA will be using Reporting Model which is a near-real time transaction model, where simplified e-invoices are reported to ZATCA’s E-invoicing Portal within 24 hours from issuance. Once simplified e-invoices are uploaded, they will be validated, acknowledged, and reported back to the taxpayers.

In order for business to ensure timely readiness and to be complaint with the E-Invoicing Regulations, it is highly recommended to follow the below steps:

E-invoicing is the process aims to convert generating of manual invoices into electronic process which allows processing and exchanging of invoices, credit notes and debit notes in electronic format between taxpayers using ZATCA’s integration solutions.

E-invoicing will take place in two phases, Phase One will come into effect on 4th of December 2021 where all taxpayers are required to generate and maintain e-invoices. Whereas Phase Two will roll out in waves starting from January 2023, where all taxpayers are required to integrate their system of generating e-invoices, with ZATCA.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax