Adjustment on Account of Bad Debt Relief- Public clarification

This article on the bad debt adjustment covers three sections:

Relevant provisions of VAT law

According to article 64 of Vat Decree Law -

Article (64) - Adjustment for Bad Debts

1. A Registrant supplier may reduce the Output Tax in a current Tax Period to adjust the Output Tax

paid for any previous Tax Period if all of the following conditions are met:

a. Goods and Services have been supplied and the Due Tax has been charged and paid.

b. Consideration for the supply has been written off in full or part as a bad debt in the accounts of the supplier.

c. More than six (6) months has passed from the date of the supply.

d. The Registrant supplier has notified the Recipient of Goods and the Recipient of Services of the amount of Consideration for the supply that has been written off.

2. The Registrant Recipient of Goods or Recipient of Services shall reduce the Recoverable Input Tax for the current Tax Period related to a supply received during any previous Tax Period where the Consideration has not been paid and all of the following conditions are met:

a. The registered supplier reduced the Output Tax as stated in Clause (1) of this Article and the Recipient of Goods and the Recipient of Services has received a notification from the supplier of the Consideration being written off.

b. The Recipient of Goods and Recipient of Services received the Goods and Services and the relevant Input Tax was deducted.

c. The Consideration was not paid in full or in part for the supply for over (6) six months.

3. The reduction stated in Clause (1) and (2) shall be equal to the Tax related to the Consideration which has been written off according to paragraph (b) of Clause (1) of this Article. This is to be read with Article 25 and 26 of decree law:

Article (25) - Date of Supply

Tax shall be calculated on the date of supply of Goods or Services, which shall be the earliest of any of the following dates:

1. The date on which Goods were transferred, if such transfer was under the supervision of the supplier.

2. The date on which the Recipient of Goods took possession of the Goods, if the transfer was not supervised by the supplier.

3. Where goods are supplied with assembly and installation, the date on which the assembly or installation of the Goods was completed.

4. The date on which the Goods are Imported under the Customs Legislation.

5. The date on which the Recipient of Goods accepted the supply, or a date no later than (12) months after the date on which the Goods were transferred or placed under the Recipient of Goods disposal, if the supply was made on a returnable basis.

6. The date on which the provision of Services was completed.

7. The date of receipt of payment or the date on which the Tax Invoice was issued.

Article (26) - Date of Supply in Special Cases

1. The date of supply of Goods or Services for any contract that includes periodic payments or consecutive invoices shall be the earliest of any of the following dates, provided that it does not exceed one year from the date of the provision of such Goods and Services:

a. The date of issuance of any Tax Invoice.

b. The date payment is due as shown on the Tax Invoice.

c. The date of receipt of payment.

2. The date of supply, in cases where payment is made through vending machines, shall be the date on which funds are collected from the machine.

3. The date of Deemed Supply of Goods or Services shall be the date of their supply, disposal, change of usage or the date of Deregistration, as the case may be.

4. The date of a supply of a voucher shall be the date of issuance or supply thereafter.

FTA public clarification VATP024

All of the above combined will help to conclude that :

A VAT registered supplier is generally required to account for output tax in the same tax period in which a tax invoice is issued. This is on the basis that no other event which triggers the date of supply has taken place prior to the date on which the invoice is issued.

If that invoice is not paid and a bad debt situation occurs, the VAT accounted for by the supplier is likely to become a real cost to the business. The Bad Debt relief scheme seeks to provide a relief to the supplier in such instances by permitting an adjustment of the VAT charged but not paid by the customer.

In order to benefit from the Bad Debt relief scheme, the following four conditions must be met:

1. The goods and services should have been supplied and VAT on the supply should have been charged and accounted for; this condition will be satisfied where the supplier has charged VAT on the tax invoice and has also accounted for VAT to the FTA via its tax returns.

2. The consideration for the supply should have been written off in full or in part as a bad debt in the accounts of the supplier;

It is important to note that the bad debt relief can only be taken to the extent of the consideration written off in the accounts. Therefore, if only a part of consideration is written off, a bad debt relief can be taken only to the extent of such written off consideration.

3. More than six months should have passed from the date of the supply;

This means that a supplier must wait for six months from the date of supply to initiate the process of bad debt adjustment. The FTA considers that during the course of these six months, the supplier should engage with the customer to recover the debt and collect the outstanding amount.

4. The supplier should have notified the customer of the amount of consideration for the supply that has been written off.

The FTA considers that the notification issued to the customer (by letter, email, post, or any other similar communication ) stating the amount of consideration that has been written off must, at the minimum, contain the following information in addition to any other information that the supplier may choose to include:

Please note that whilst it is not necessary for the supplier to receive an acknowledgement from the customer before taking the bad debt adjustment, a supplier needs to evidence documentation and/or that best measures were taken to notify the customer. Evidence to this effect must be retained.

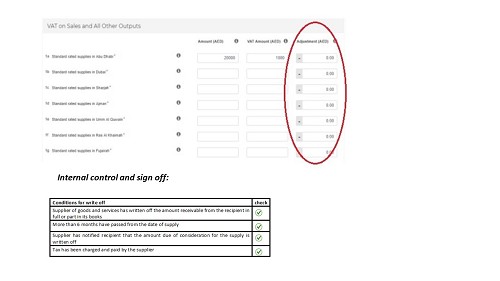

Presentation in VAT return

Any adjustment on account of bad debt relief should be made in the “Adjustment column” of Box 1 of the VAT Return. The adjustment amount should be the VAT amount only and should be reported for each Emirate, where applicable, in accordance with the respective Output Tax amount being adjusted.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax