FTA [Federal Tax Authority of UAE] has recently issued a long awaited VAT Guide on ‘Automotive sector’. It has clarified many matters related to this sector for VAT treatment. Two things however stand out:

1. Available for Personal Use

1. 'Available for personal use' [which makes the Input VAT non-recoverable on vehicle purchase, rental or leasing and other associated vehicle related expenses] has been made more subjective by explaining the exclusion in terms of "emergency use" and "nature of the job" when a vehicle is taken home by an employee and such act will not of itself preclude a taxable person from recovering input tax if these two conditions are prevailing.

This clarification on 'available for personal use' should not have been left to the taxable person. It should have been as demarcated as FTA has done for Input VAT treatment of Medical Insurance Premium of dependents when paid by the employee's company. It cannot be claimed as Input VAT Credit.

If vehicle is kept at office after business hours, claim the Input VAT and if taken home under any circumstances (including emergency and nature of job requirement) , Input VAT cannot be claimed, blocked.

It will be interesting to see how FTA Audit team handles this section of the Guide and implement it for the benefit of, both FTA and Taxable person.

2. A Toll on VAT Treatment of SALIK

Background: (as given in this Guide)

It is observed that certain suppliers do not consider that they should account for VAT on the entire sum that they receive for the leasing of cars to VAT. It is, however, the supplier’s obligation to carefully consider the different components of fees charged by them and account for VAT accordingly.

In the explanatory example, it has been mentioned as "The SALIK deducted from the account is essentially a cost incurred by car leasing company to provide car leasing services to the customer. The recharge of such a cost is subject to VAT"

Now, as per VAT Legislation, Consideration is “all that is received or expected to be received for the supply of goods or services, whether in money or other acceptable forms of payment”.

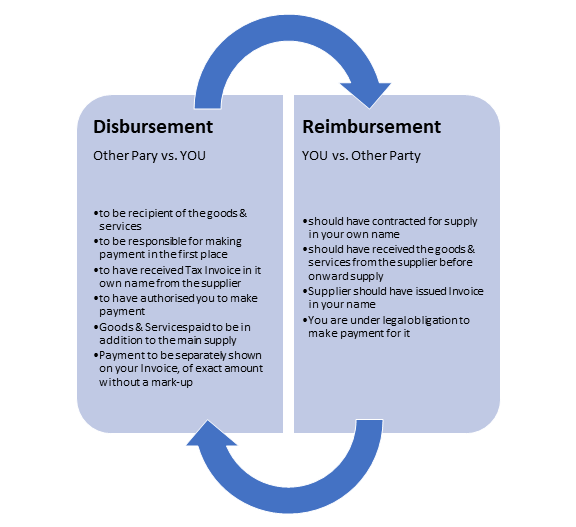

In Public Clarification VATP013 on 'Disbursements and Reimbursements', these points have been mentioned which may be relevant here:

In commercial transactions, a person may incur expenses and subsequently recover such expenses from another party. The VAT treatment of the subsequent recovery of expenses depends on whether the recovery is tantamount to a “disbursement” or “reimbursement”.

The first step to determine whether a recovery is a disbursement or reimbursement is to establish whether you have acted as a principal or an agent in purchasing the goods or services.

Where you have acted as an agent, the recovery would generally amount to a disbursement. A disbursement does not constitute a supply and is, therefore, not subject to VAT. Out of Scope, to be precise

On the other hand, where you have acted as a principal, the recovery would generally amount to a reimbursement. A reimbursement is considered to be a part of consideration for the supply and follows the same VAT treatment as the main supply. Take it as taxable at Standard Rate of VAT.

Based on the Principles of Disbursements and Reimbursements as defined therein, SALIK is both a disbursement and reimbursement. There is no clear cut demarcation. Please see the chart below to evaluate on your own.

RTA on its website defines SALIK as “ Salik is Dubai’s automatic road toll collection system”. Toll is the tax you pay for using a particular service provided by the government.

I am of the opinion that SALIK is neither disbursement/reimbursement nor a cost incurred by car leasing companies. It is neither a supply nor a consideration for the supply paid. It is a funding mechanism whereby car leasing company puts in the money in its account which gets deducted based on toll road usage. Customer just pays back this funded facility availed. SALIK amount paid by car rental and leasing companies when invoiced to its customers should be “Out of Scope” of VAT, based on this ‘funded facility’ criteria and not based on disbursement principle.

If this be not so, each of the car rental and leasing company who have not charged VAT on SALIK amount, is exposed to AED 500 -1000+ for the last 42 months gone by on each of their vehicle.

It’s almost the similar scenario which Insurance companies found themselves in during the transition period of VAT Legislation vis-à-vis Individual Insurance policies.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

You can access Law including Guidelines, Cabinet & FTA Decisions, Public Clarifications, Forms, Business Bulletins for all taxes (Vat, Excise, Customs, Corporate Tax, Transfer Pricing) for all GCC Countries in the Law Section of GCC FinTax